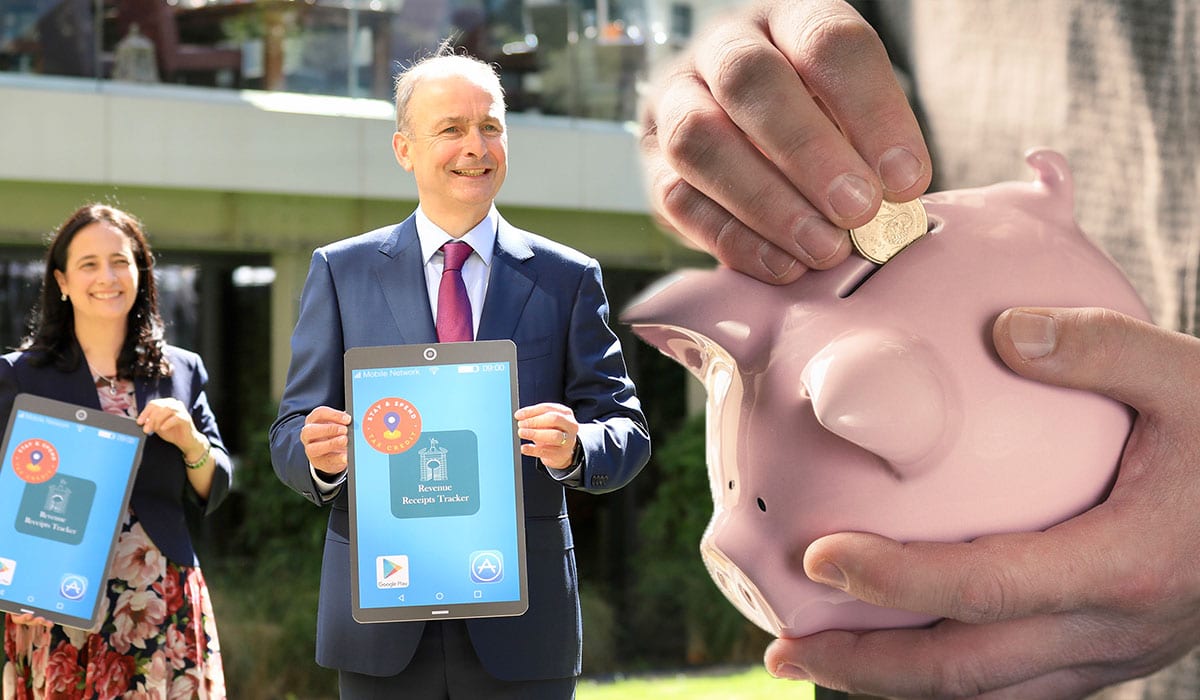

The new Stay and Spend scheme allows you to claim tax back on accommodation, food and non-alcoholic drink (known as qualifying expenditure) bought between 1 October 2020 and 30 April 2021.

We are a participating business and we are listed on the Revenue’s list of ‘Qualifying Service Providers’. This means, that when you book your break with us, you are entitled to claim expenses for your stay.

Under the terms of the incentive:

- You must spend a minimum of €25 in a single transaction on qualifying expenditure and submit the receipt to Revenue (we will provide you with recepits throughout your stay that you can keep for this).

- You can submit receipts up to a total of €625, or €1,250 for a jointly-assessed married couple

- Revenue will provide an income tax credit of up to €125 per person, or up to €250 for a jointly-assessed married couple

You can claim expenses on:

- Fáilte Ireland registered accommodation – which means that your stay in our hotel qualifies for this scheme when you book directly with us on this website.

- Food and non-alcoholic drink – served in a café, restaurant, hotel – – which means that your food and non-alcoholic beverage purchased in our hotel qualifies for this scheme.

You cannot claim expenses on takeaway food, alcoholic drinks, drinks (either alcoholic or non-alcoholic) served without food or amounts below €25, so you can add everything to your room bill and we can give you a receipt at the end of your stay, or you can pay per transaction and keep your individual receipts.